One of the best books on a financial crash ever was John Kenneth Galbraith’s appropriately titled The Great Crash 1929. Galbraith waited a quarter-century to publish. By then, even if the story of brokers jumping from windows had been exposed as myth, there was no doubt that Black Tuesday had been the real deal.

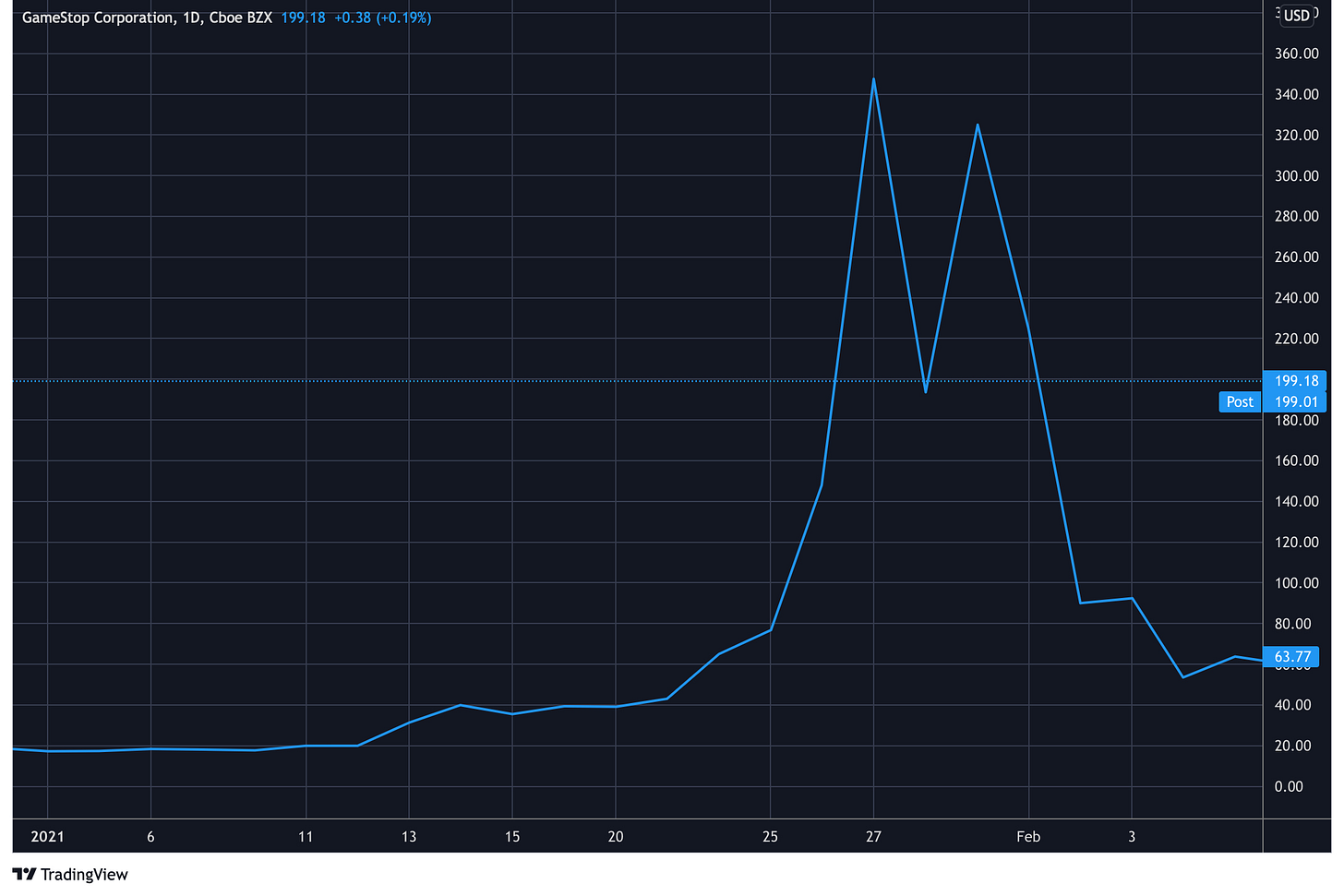

Gestation periods have gotten shorter (for some writers, anyway). It seems only months ago that the shares of GameStop, a money-losing video game purveyor, rocketed out of sight. That is because it was only months ago.

Not one for waiting, Ben Mezrich has published The Antisocial Network, a page-turning account of the greatest short squeeze at least since 2019. Mr. Mezrich, a best-selling writer, theorizes that disgruntled small fry on social media constitute a disruptive vanguard who may upset markets much as anti-elites on Facebook upset American politics. Indeed, he argues, with small investors willing to absorb losses just to freak out professional short-sellers, stock prices might lose all connection to the fundamentals, like “an untethered balloon.”

This would be a shame for, in order of importance, the American economy, capitalism and your columnist. “Intrinsic Value” believes in its marrow that securities markets sooner or later return to value (otherwise, why even bother with the stock market, since we already have Las Vegas and it is more fun).

You can read my Wall Street Journal review, modestly asserting the perpetuity of the fundamentals, here.