America’s Strategic Petroleum Reserve was set up in the aftermath of the energy crisis triggered by the 1973-‘74 Arab oil embargo. The idea was to stockpile enough oil to keep the country running in a crisis, and give the U.S. a temporary breather against supply interruptions or international blackmail.

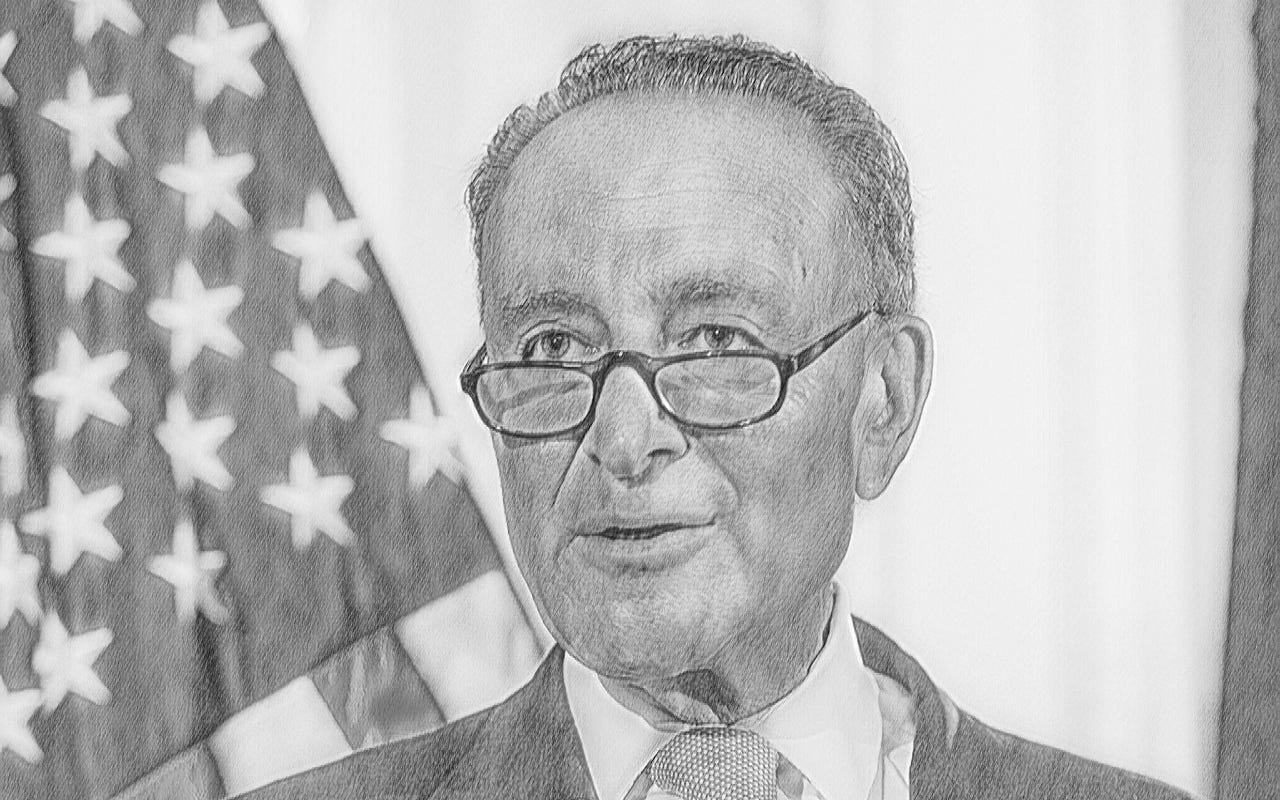

With energy prices soaring, Chuck Schumer, the Senate Majority Leader, has endorsed the singularly bad idea of tapping the SPR to bring down oil prices. He is pressuring the White House to open the spigot, to provide “immediate relief at the gas pump.”

Chuck must be kidding. Oil traders aren’t stupid, even if some elected officials assume that voters are. The entire SPR, which holds 620 million barrels in four underground caverns, would supply America for a month, or two to three months assuming that only imports (and not domestic production) were halted. And then it would be empty.

The SPR is intended for genuine emergencies. And international oil reserves are still concentrated in autocratic, unstable or unfriendly hands (the top eight nations by reserves include Venezuela, Saudi Arabia, Iran, Iraq and Russia).

America is less dependent on imports than it was. Since the pandemic, imports and exports have been roughly in balance, and less of our imported oil comes from the Persian Gulf. But oil is fungible. If hostile nations halted supplies, oil from allies would become scare as well. And imports still total eight million barrels a day, more than 40% of U.S. consumption.

Tapping the SPR would be like using a retirement fund to fix an ongoing budget deficit, i.e., it would paper over a long-term problem with a Band Aid. It’s almost the definition of bad government. Worrisomely, Energy Secretary Jennifer Granholm says President Biden is considering it.

Prices send signals, and oil prices are sending two of them. One is a simple reflection of the fact that the Federal Reserve is printing more dollars. Commodity prices across the board have been surging.

Secondly, because investors are worried about climate change and/or about governmental restrictions on oil, investing in fossil fuels is lagging. Soaring oil prices tell us that fear in the oil patch is running ahead of alternative fuel development.

If you are worried about climate change, rising fossil fuel prices are a good thing, because they encourage conservation and render development of renewable energy, as well as nuclear power, more attractive.

Think of high gas prices as a do-it-yourself carbon tax. It’s the market’s way of shifting some of the burden of developing new energy sources to the present generation.

Good leadership would encourage higher energy production. It should also encourage ‘70s style conservation. Very roughly, lowering thermostats by three degrees would reduce energy consumption by a tenth.

Schumer’s crowd-pleaser would, conversely, encourage profligacy and complacency.

And at a time when autocrats are dangerously on the rise, and democracies are visibly on the defensive, it would embolden dictators from South America to the Persian Gulf. Way to go, Chuck.

Book News

My new book, Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War, will be published by Penguin Press in March 2022.

You can preorder Ways and Means here:

Chuck is a moron. Really? Just a year ago we were making our own gas. And paying alot less cash for gas. I wonder how rates got so high? We all know the truth about that question. We have enough gas right here in the good old USA to supply the whole country for decades.