The Crypto Mess (Pt. 2)

The Structure is Rotten

Sam Bankman-Fried, founder of FTX, was hailed as a crypto prophet. He was feted as a savior for putting crypto on a stable and ethical footing and the praise at times stretched credulity (Fortune suggested he was the next Warren Buffett).

Reputedly worth $25 billion, the 30-year-old mogul loftily declared that it was his duty to improve the “aggregate utility of the world” and promised to give away the bulk of his fortune. Mission accomplished.

Last week, FTX suffered the equivalent of a bank run and froze its operations. Mr. Bankman-Fried saw his net worth plummet by an estimated 94%. On Friday, his firm filed for bankruptcy, stranding 100,000 creditors. Customers have lost billions, quite possibly for good.

Mr. Bankman-Fried’s brief claim to fame was to have supposedly put the crypto business on a mature footing, safe for ordinary investors and institutions.

His more lasting legacy will be to demonstrate the converse: no “ecosystem,” to use the term beloved of digital savants, is more secure than the business that underlies it.

Ontario Teachers’ Pension Plan entrusted FTX with $95 million. What was a retiree fund doing in crypto? At its annual meeting in April, Ziad Hindo, chief investment officer for the Ontario fund, said, “We’re not really speculating on whether prices of crypto assets … are going up or down.” He said the fund was speculating on trading volumes. It's unclear that newly impoverished teachers in Ontario will appreciate the distinction.

Numerous sophisticated institutions made the same bet. Eighty put up capital over the last two years on forgiving terms: without insisting on oversight. Among the smart money investors who lost money: SoftBank, BlackRock, Third Point LLC, and Tiger Global. Sequoia Capital, the West Coast venture firm, was so smitten by Bankman-Fried it posted a reverent profile of him on their website. Quarterback Tom Brady took equity in FTX in return for serving as a company shill. (Pick six.)

FTX is likely to face serious legal issues. Reportedly, it commingled funds, lending money to a hedge fund also run by Bankman-Fried. As rumors of FTX’s troubles circulated, Bankman-Fried tweeted, “We don’t invest client assets (even in treasuries).” The tweet was later deleted. The Department of Justice and the Securities and Exchange Commission are investigating.

Regardless of the legality of the related-party transactions, it should be clear that FTX’s reputation as a blue-chip was a joke. Bankman-Fried’s real business was speculation. His hedge fund, Alameda Research, borrowed $10 billion from FTX and pursued “a variety of trading strategies to make money from volatility, a riskier business model,” according to the Wall Street Journal. Perhaps he had not read his history. Long-Term Capital Management, the genius hedge fund, also foundered on volatility trades.

Another strategy was “yield farming,” investing in crypto tokens proffering high rates of interest. But how can the interest be secure when the tokens are only …. tokens? That is the difference between crypto kids and Buffett, who invests in businesses that generate real cash.

According to Binance, a rival that agreed to rescue FTX until it realized what a mess its finances were, the hedge fund had collateralized its assets with digital tokens minted by FTX. This violated the spirit of a cardinal rule of banking; bank reserves cannot consist of a bank’s own paper. (Otherwise, a bank could print endless paper to back endless loans.) As the Binance founder tweeted: “Never use a token you created as collateral.”

FTX was under no reserve requirement, because it was not a bank. But customers used it in a bank-like manner, to park funds. It was not the first and is unlikely to be the last. The entire structure of crypto rests on faith that the tokens are good.

Speculation is necessary to market capitalism. Chicago exists so that commodities traders can discover a price for wheat so that farmers in Kansas can know what they are getting.

But here’s the thing. We actually consume wheat. Ditto, in one form or another, copper, cotton, sugar and coffee. Speculation in commodities, however mercurial, plays a useful role.

But nobody consumes crypto. Nobody uses it as a currency.

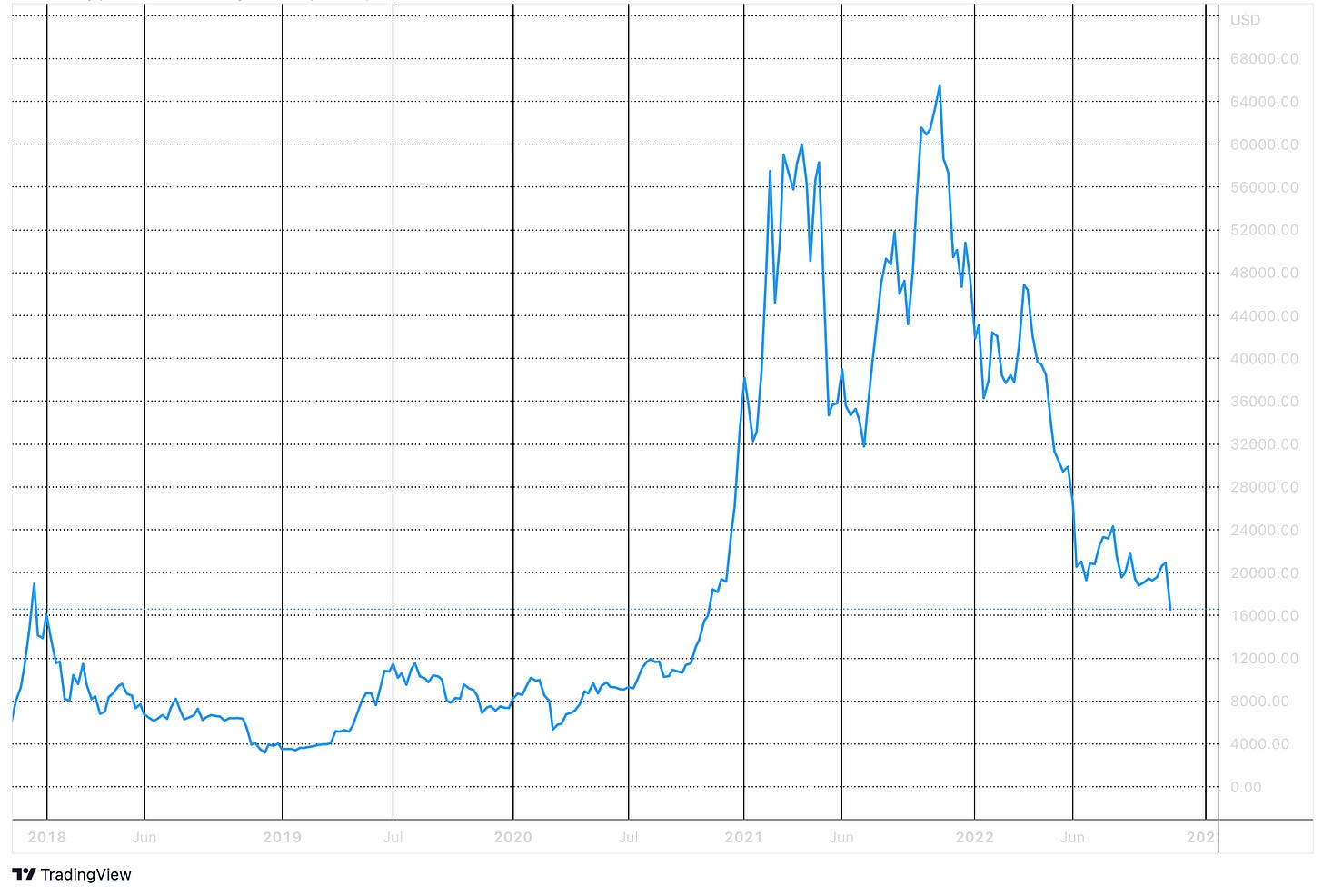

No one uses it for any purpose other than an illicit one or to speculate. In view of the nearly three trillion-dollar peak value of crypto assets, now reduced by approximately two-thirds, I suspect that not even its use in money laundering can compare. Crypto is Las Vegas, with all the economic purpose of a slot machine.

The crypto industry has been aggressively self-promoting. Its marketing is aimed at projecting a patina of institutional soundness. Firms that would not be caught running a slot machine--hello Fidelity and hello Goldman Sachs—have responded as bees to honey. No one marketed with more determination than Bankman-Fried. He signed up celebrity touts such as Steph Curry and Larry David, spent millions on Super Bowl ads, plastered the FTX name on the Miami Heat arena.

To get an inside track in the Beltway, one crypto firm after another has hired former regulators as consultant pitchmen or directors. Bankman-Fried was a prominent lobbyist (and a large Democratic donor), presenting himself as an avatar of sensible regulation. He lured Bill Clinton to his lair in the Bahamas. The general counsel at FTX US is Ryne Miller, who was legal counsel to Gary Gensler when Gensler was chair of the Commodity Futures Trading Commission. Gensler is even better placed now (he’s chairman of the SEC).

Senator Elizabeth Warren has called on the SEC to enforce the law on crypto platforms. What law is that? Crypto is not a security, and its platforms aren’t “banks,” thus the industry has largely slipped through the regulatory net. Senator Warren should get busy. Crypto cries out for regulation, which will probably require enabling legislation. A good start would be a Congressional hearing. Let the public learn who has taken crypto money, and which former regulators are sanitizing the industry on crypto boards.

As for Bankman-Fried, he has said he is sorry.

The headline is with gratitude to Viken Berberian, author of a splendid graphic novel of approximately the same name

Investing in the future possibility of Fusion Energy is probably a better idea than investing in crypto coins.

If crypto is a "slot machine", why give it the imprimatur that comes with regulation?