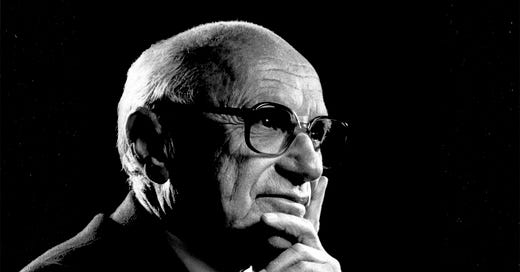

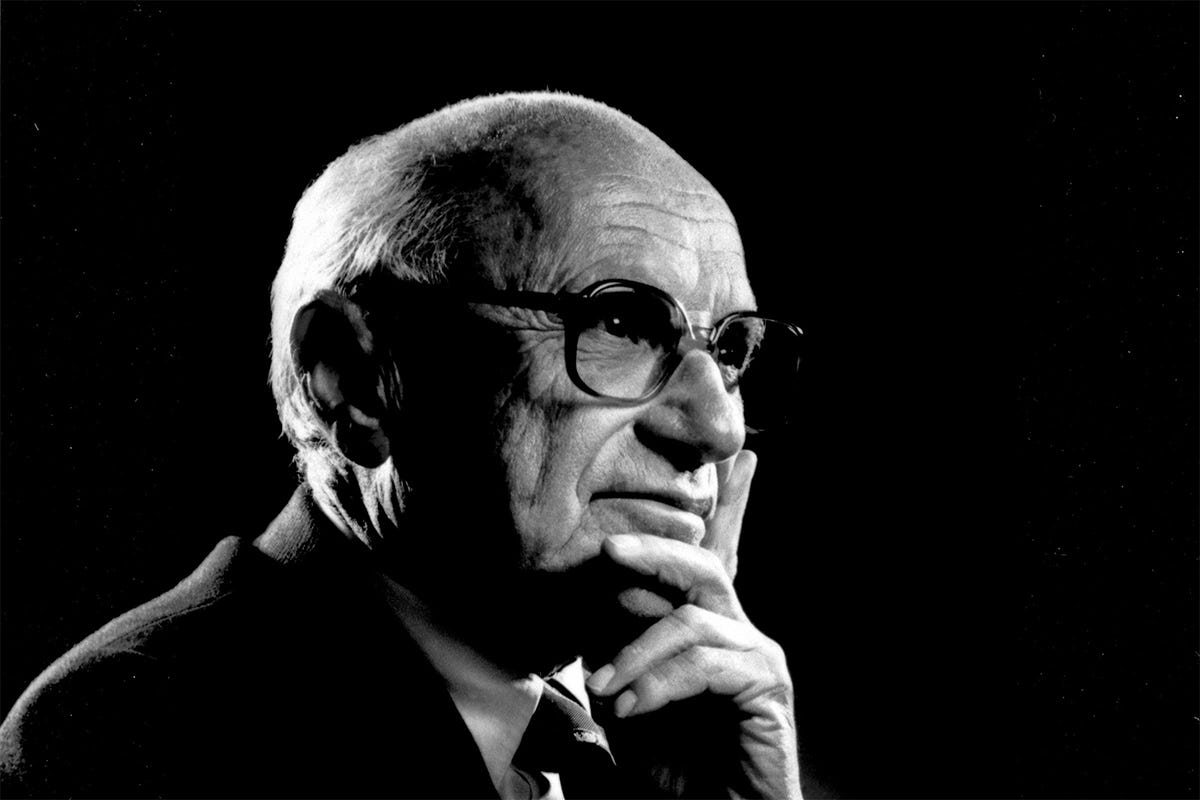

In Capitalism and Freedom, Milton Friedman argued that free markets were as essential to democracy as free elections. We are putting the great economist’s theory to the test.

One after another of America’s checks and balances are performing poorly. The Congress is unwilling and seemingly afraid to vote against the President.

The Cabinet is made up largely of sycophants who have no basis for office other than loyalty to the President, and therefore express no independent voice.

The judiciary retains its independence, but issues work their way to the courts only in time—after damage may be done and where, potentially, power to enforce remediation is lacking.

Most disappointing are civil institutions such as law firms. All it took was a threat of Executive extortion to show that in some reputedly great firms, the partners had the pinstriped suits but not the spine to keep them upright.

Which brings us to the market. After Trump’s election, it was said in many quarters that the market would provide a check—that there were lines that even Donald Trump wouldn’t cross lest he cause the country, including his supporters, intolerable economic pain.

In recent days, the President’s run of new tariffs has capsized the stock market, causing horrendous daily losses, cumulatively 18 percent from the peak on the S&P 500 and 22 percent on the Nasdaq. In total, more than $10 trillion has evaporated overnight.

Wealthy investors have lost a fortune. Workers with meagre savings have lost something even more precious—a vital chunk of their retirement security. Moreover, the entire fabric of American business has been upended. Unknowable is whether the companies whose stock quotations are awash in red will cancel investments, trim their sails, lay off workers. Whether – as Wall Street forecasts – a recession looms.

The President had said he could not rule out a recession – a literal truth—but he said it with a cavalier tone such as to suggest that the threat of a recession would not deter him from his course.

His brassy response to the market crash was similar. Trump plays golf, the market burns.

But the market passed its first test—which is not to be fooled. The President insists that trade deficits can be cured by tariffs. The market doesn’t believe him.

The President implies that if everything is “made” here America will experience a great prosperity, a “liberation.” Au contraire (and we know this President is just so fond of French) the market knows that trading nations have always been prosperous whereas, as David Brooks pointed out, isolation breeds “stagnation” and, indeed, decline. https://www.nytimes.com/2025/04/03/opinion/tariffs-trump.html

The President believes that every imported product is evidence of foreigners ripping us off. The market understands that our ability to print dollars and exchange them for automobiles and avocados is a national strength—not a weakness. Nations lend to us—take our paper—because they have faith in what the dollar can buy, what America produces.

The President, finally, claims to be reacting to an “emergency.” When Trump took office, unemployment was 4 percent. Emergency? The market says the emergency is now—of the President’s creation.

The stock market has communicated popular displeasure perhaps more forcefully than the press. The market is like a fourth branch, a truly separate branch. It has its limitations; it obsesses on the short-term, it is wildly un-egalitarian, but it is democratic and it cannot be censored.

Even Trump can’t pretend that the market is up. Not even his foremost supporters would believe that.

But will the market check work?

We are in new territory. No other President has caused a market crash before. Not Herbert Hoover, not Jimmy Carter, not Joe Biden, with whom this President so loves to compare himself.

Virtually every previous market crash was the result of shifting economic currents, changes in interest rates or wars or terrorism or a pandemic. They arose from genuine crises or at least the fear of them—not a phony “emergency” such as Trump cooked up.

And in cases where policy errors contributed to market meltdowns, the mistakes were, primarily, those of the Federal Reserve. But Trump is the sole architect of his tariff policy and he is the first President to engineer a crash. As Trump would say, he is the FIRST.

If and as the pain of the Trump tariffs increases, the pressure on him will grow. He will look for a way to declare victory and retreat.

Even his most ardent supporters in the House of Representatives, abject and supine though they may be, will face the heat from voters. Trump still needs Congress to pass his tax measure, and Congress will be in a position to bargain. Whatever powers the President has to make tariff policy (an issue now in the courts), they derive from Congress. Congress can take them back. Some Republicans have already thrown their support to a measure that would permit Congress to remove tariffs by a simple majority vote.

Trump may genuinely believe in his tariff policies, which as Larry Summers tweeted are the result not of any proven economic theory but of a 40-year personal fixation.

But voters care less for his fixation than for their own portfolios. It could be argued that even in the former Soviet Union—a system with no political checks—the market check ultimately worked by bankrupting the country to the point where the government collapsed.

It won’t take that long here. The market referendum is clear. Congress will listen or it will itself be held to account.

Good analysis, Mr. Lowenstein. Congress needs to take the wheel, and Milton Friedman was right: free markets are as essential to democracy as free elections. (And, pondering a darker thought of its corollary: tanking the market with a motive to take the nation down a mercantilism/isolationism path may be setting the table for dictatorial government.)

We haven't had free markets in decades. This post sounds like the cries of an insider seeing their privileged status being taken away.